Actionable B2B Data In Your ICP

The success of your sales conversations are a function of how relevant you are to your prospects success. Know more about your ideal customers so you can provide more value to the conversation and build a real relationship.

B2B Intent Data

How It Works

Sales Intelligence

Growth Intent Triggers

Companies that are growing, adding services and solutions and ultimately spending money are the companies you should be speaking to. We are the only b2 data provider that combines our best in-class database with sales intelligence. These key bits of information like companies that are currently hiring, just received a funding round, released an IPO, opening new locations etc indicate growth opportunities perfect for the services/solutions you provide.

Sales Intelligence

Growth Intent Data

Growth Intent is the new Intent data. Intent data associated with content readership is not really intent data. Utilize real growth b2b intent data through a combination of our lead generation database and growth triggers. Knowing the companies in your ICP that are currently spending is the key to a healthy pipeline of qualified prospects.

B2B Intent Data

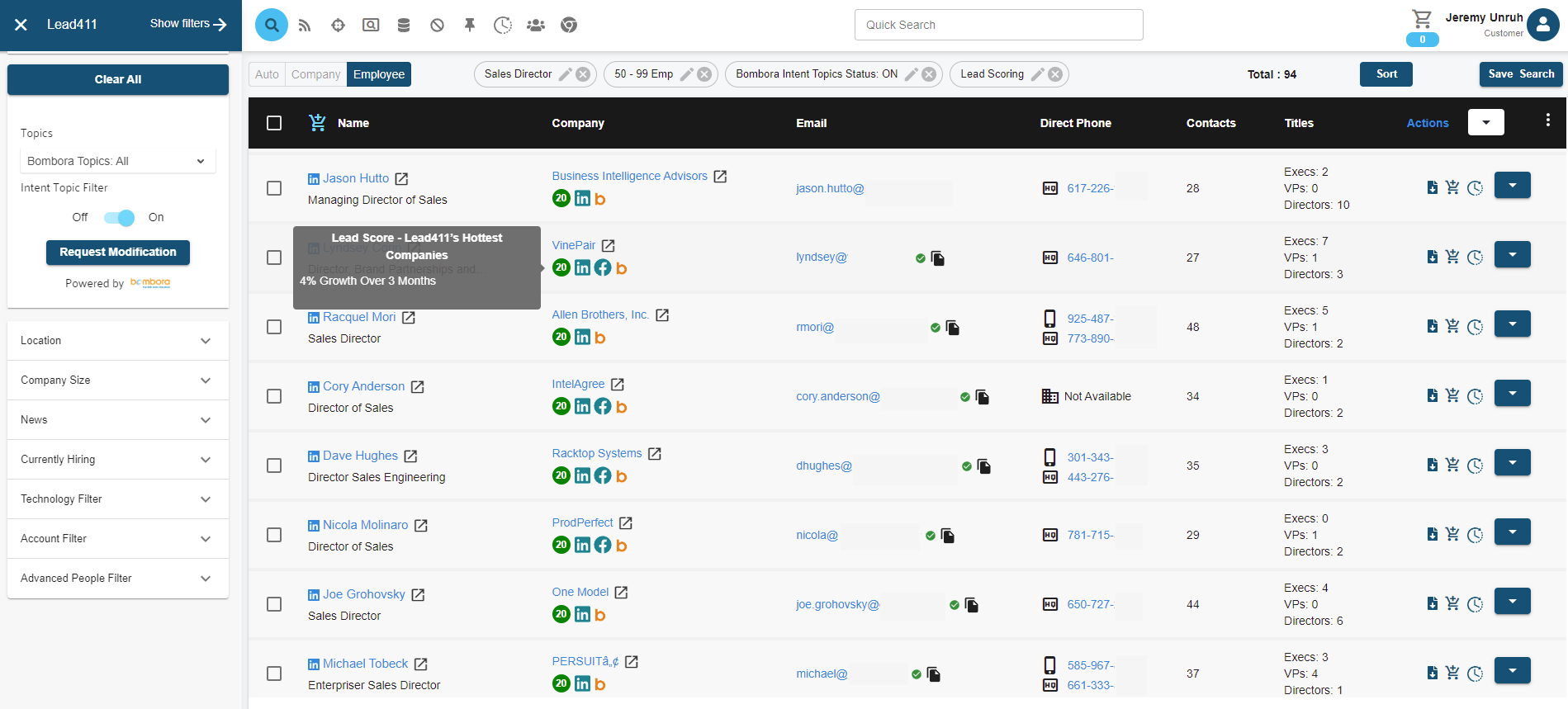

Bombora

Lead411 also offers Bombora B2B Intent Data. Customers can select 5-25 topics and discover companies that are actively looking for services and solutions you provide. Not only can you get information on the companies researching these topics, but Lead411 allows you to pinpoint decision makers within these companies. This service is unmatched in the B2B industry and is a huge advantage for our customers.

Sales Intelligence

Advanced Search

Advanced search metrics to hone in on your ICP (Ideal Customer Profile). Our advanced search filters are perfect for pinpointing your ICP. Utilize the functionality of our b2b data platform to search for specific contacts, segment by job title & function, filter by company (size, revenue and industry) and narrow in on specific locations. Utilize our contact enrichment api to enhance your own b2b contact database.

Have Questions?

Our Customers

Who We Serve

Sales Services

Create a healthy pipeline, close more deals and generate more revenue.

SaaS & Technology

Do you sell into certain SaaS or Tech Stacks? Lead411 has you covered!

Marketing Services

Create lists, send your messaging, build your client’s brand and build your business.

Recruiting

Looking for new clients or candidates, Lead411 has the ideal data for your workflow.

You’re In Good Hands

Why Choose Lead411?

Our sales intelligence tracks key company events that indicate spending and growth. Sell into companies at the perfect time and get to your R.O.I quicker.

Quality Data

The Only Provider With Triple Verified Emails

Email Verification

The email addresses in our database are verified using SMTP, human-verified, and email open validation.

Live A.I. Research

If an email address isn’t currently in our database, use our A.I. based research tool on the fly to find the best possible match.

Re-Verification Schedule

We have an unmatched email verification schedule compared to the competition; all of our emails are re-verified every 3-6 months.

Phone Numbers

Double Verified Direct Dials

Phone prospecting is one of the more labor-intensive activities in the space. Dialing to numbers that are out of date, general information lines or incorrect is not only ineffective, but it’s also incredibly frustrating. You can change all of that. Be more successful with Lead411’s double verified direct dials.

Human Verified

Our vendors ensure we supply the most accurate phone numbers to ensure the right recipient gets your call.

Location Match

We determine if the phone number matches any of the locations where the recipient has worked either currently or in the past to ensure its accuracy.

Millions of leads produced for thousands of happy customers.